The ready availability of construction equipment and the materials used to construct projects is critical to construction project delivery in every corner of the world. Whether by pandemic, inflation, war, protective tariffs or increased competition for a finite supply, scarcity of parts and materials and their price volatility have triggered project delays, and worse still, project cancellations. Constructors are dealing with vendors who refuse to hold prices firm for anything other than very short windows. Designers have become the judge of constructors’ extra cost claims stemming from skyrocketing material costs or delivery delays in mid-project. Battles and finger-pointing have erupted over spiraling project delivery costs that, while recognized as possible at the outset, were beyond anyone’s capacity to accurately predict. This paper explores the causes of and reaction to the supply chain disruption and the chaotic price spikes of construction materials.

Inventory Management 101 – Supply Chain Basics

The Oxford English Dictionary defines “supply chain” as that series of processes involved in the production and supply of goods, from when they are first made, grown, etc. While there are as many supply chains as there are products that flow into the marketplace, supply chain disruptions cannot be understood without first understanding some basics about inventory management.

- Toyota and “Just-In-Time” Production

Following World War II, Toyota set about to become a competitor in the automotive industry. Taiichi Ohno, an industrial engineer with Toyota, developed what is today known as the Just-In-Time (“JIT”) production model. While Toyota prefers to call it the “Toyota Production System,” or TPS, Ohno recognized that Toyota was faced with myriad production constraints, most notably limited resources in post-WWII ravaged Japan. So Ohno set about to develop a manufacturing system based on a rate of production that matched demand. Presumably, his blueprint for JIT was inspired by observing an American supermarket, where a customer took the desired amount of goods from the shelf and the store restocked with just enough to fill the space.

The central objective of JIT is manufacturing only what is needed, when it is needed, and in the amount needed. Achieving this objective hinge on eliminating excessive production resources, overproduction, excessive inventory, and unnecessary tie-up of associated capital investment. From a supply and inventory management perspective, Toyota was able to minimize its inventory, and thereby slash warehouse space and reduce unnecessary cost-carrying and improve efficiency. An added advantage was that reduced inventory could limit risk if defects or design changes later came to light in those stocked parts. Fewer stocked parts with defects means fewer such parts requiring rework or relegation to the scrap heap.

In a 1985 paper on inventory control in manufacturing, R.C. Estall offered a stark example of the contrast between the Toyota’s operations under a JIT production model and the production practices of General Motors. He noted that in 1984, GM had 3,500 suppliers compared to 225 for Toyota, and GM maintained five days of inventories valued in 1982 dollars at $5 billion, whereas Toyota had practically assembly lines that were fed by inventory procured on daily, or several times per day basis.[i]

While JIT’s strength derives from being lean and avoiding masses of stocked inventory, and it is tied to anticipated demand, the system’s weakness stems from a lack of flexibility to absorb demand shocks that can arise either internally or externally to the manufacturer’s operations. For example, Ford recently incurred a dramatic shock when it was unable to procure computer chips for tens of thousands of its reintroduced Bronco. With no chips for the assembled vehicles, Ford had to park Broncos in scores of open fields in and around suburban Detroit.

Factors external to the supply and production chain can also upend a JIT organized production system, such as natural disasters, a cyber-attack, or worse still, a pandemic triggered lockdown. On May 6, 2021, the Colonial Pipeline Company became the target of the largest publicly disclosed cyber-attack against critical infrastructure. The Colonial pipeline system is comprised of more than 5,500 miles of pipeline that supplies nearly half of the refined oil for gasoline, jet fuel and home heating oil to the eastern seaboard of the U.S.

A hacker group, DarkSide, which is purportedly operated out of eastern Europe or Russia, was able to access Colonial’s network and stole some 100 gigabytes of data within a two-hour period. Using that data, DarkSide’s hackers infected Colonial IT network with ransomware. To prevent a spread of the infection, Colonial shutdown the pipeline. The shutdown triggered immediate supply shortages, panic buying, and price spikes. On May 7, Colonial paid $4.4 million, or 75 Bitcoin, to the hackers, and on May 12 Colonial restored operations. In early June, the Justice Department found the digital wallet of the hackers and was able to recover about half of the value of the Bitcoin ransom payment.

JIT based production also tends to promote sole-supplier relations which puts a company at heightened risk if that supplier cannot fill orders. One of the most prominent and recurring observations about supply chain disruption is the need to expand and diversify supplier relationships so that no single supplier’s inability to deliver becomes a critical choke point.

- Just-In-Case Inventory Management

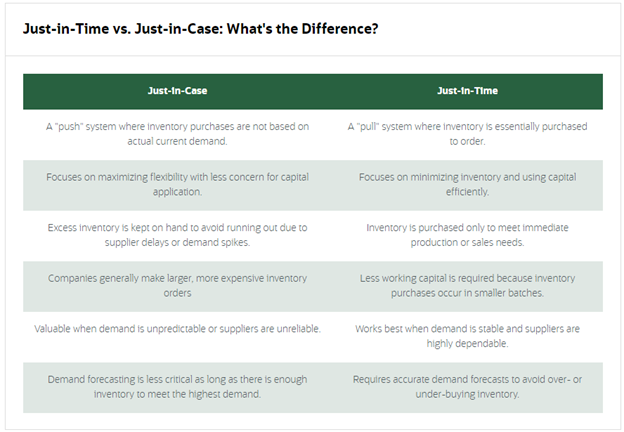

Recent shocks to the supply chain, from whatever source, have prompted a rethinking of JIT, and consideration of moving away from lean inventory practices that are central to the JIT framework. Unlike JIT, a Just-In-Case (“JIC”) production model is not driven by product demand, but by the aim of achieving maximum production flexibility. Under a JIC model, excess inventory is kept on hand to avoid supplier delays and to enable a production surge in the event of an unforeseen spike in demand. [ii]

Unique Supply Challenges in the Construction Industry

- Complexity of Construction

Unlike manufacturers, constructors face a litany of unique supply and procurement challenges, many of which are driven by the nature of construction itself. By its nature, the construction process typically involves site-based, one-off design that is often delivered through fixed-price contracting with a highly fragmented supply chain. Contractors are at least in some degree at the mercy of designers, who specify the materials to be used and maintain control of alternates. While design/build teams and value engineering can limit or reduce the impact of material specification, the preferences of owners and factors unique to the building site likewise influence wide variation in building material selection.

Design and construction also involve layers of regulatory compliance, building performance and sustainability constraints that in many cases are mandated in local building codes. On federal projects, and those involving federal funding, these ordinary burdens of project approval and delivery are now further burdened by government mandates requiring use of U.S. made materials. The Infrastructure Investment and Jobs Act (IIJA; P.L. 117-58), enacted in November 2021, made changes to “Buy America” requirements for federally funded infrastructure projects. The BAA applies to all contracts for the construction, alteration, or repair of any public building or public work in the United States.

The BAA requires contractors to use only domestic construction materials in all construction contracts unless an exception applies. Construction materials include all articles, materials, or supplies that a contractor or subcontractor brings to the construction site and incorporates into the building or work.

- A Multi-layered, Longer Supply Chain

By its nature, construction involves dynamic, long supply chains that are imbued with significant uncertainties, especially related to finance and payments.[iii] Typically, the construction industry has lengthy, network-structured, dynamic supply chains rather than short, vertical supply chains. Another inherent factor constraining the construction material supply chain is the fragmented, multi-layered configuration of the constructor group, with a prime or multiple prime contractors at the top and layers of subcontractors and sub-subcontractors and each of their suppliers’ flowing materials to the project. One disruption in supply at any given level of the pyramid can quickly cause ripple effects in the project critical path.

The construction supply chain is also inherently longer because of the substantial lead times for off-site manufacture of specified materials; namely, pre-stressed concrete components, structural steel, pre-engineered trusses, extruded metal components, and specially fabricated HVAC components, etc. Lead times connected with these specially manufactured materials have always constrained the construction supply chain, but they are now compounded by supply chain disruptions those manufacturers are encountering in the procurement of the raw materials needed to fabricate their wares.

- Stockpiling has its Limits

The sudden onset of material shortages during the pandemic triggered all manner of hoarding and warehousing of masses of inventory – and soaring price increases. As reported in a February 23, 2022 article in ConstructionDive, contractors quickly began jockeying for supplies ahead of competitors, and were forced to make cash purchase before price quotes expired within just days of an order.[iv] To store their hoards, they then rented or built warehouses. In time, “ghost orders” placed merely to lock down materials led to rationing by producers in order to preserve relationships with loyal customers.

But the notion that construction supply chain challenges can be mitigated simply by stockpiling inventory is largely an unworkable non-starter for contractors. Most notably, only finished, recurring-use materials can be effectively stockpiled. PVC pipe, adhesives, insulation, metal bar joists, roofing materials, some dimensional lumber, and even certain fixtures might make sense to stockpile, but by and large mass stockpiling of building materials carries substantial risk, requires substantial carrying costs, and stockpiling of materials flies in the face of traditional lean inventory management practices contractors have long observed. Moreover, project specific, specially manufactured components can’t be stockpiled at all.

Crimps in the Chain – the Pandemic and Many Other Factors

- Pre-Pandemic Supply Pressures, Onset of COVID, and the Bull Whip After Effect

While there has been much discussion about the pandemic’s trigger of supply chain disruption, in fact material supply problems were impacting the construction supply chain well before the pandemic struck. These factors ran the gamut from increased demand for a finite supply as a result of emerging third world economies, to trade wars and tariffs. Since the 1980s, the U.S. construction industry has become more dependent on materials produced in Southeast Asia. In the U.S., about thirty percent of all building materials imported come from China alone. That shift did not come without substantial risk that manifest during the pandemic – the risk stemming from far larger transportation logistics with suppliers located across the Pacific Ocean.

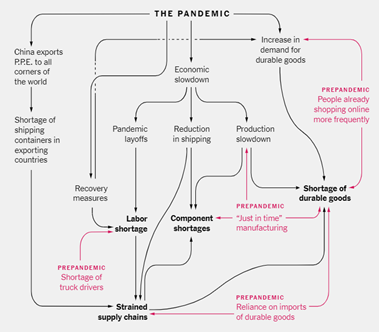

As the COVID pandemic spread through Asia, factories that produced materials shutdown, and in time, similar shutdowns occurred around the globe. At the same time, in China there was a pivot away from shipments of consumer goods to shipments of personal protective equipment and other products connected with containing the spread of COVID. That export shift diverted cargo containers away from suppliers to the construction industry.

Throughout the pandemic, cargo ships from Asia continued to arrive at the ports of Los Angeles and Long Beach, where 40% of shipping containers enter the U.S. Because of labor shortages and limited warehouse capacity, those shipped sat moored for weeks on end. The chart below provides a broad overview of the dominos that fell in the international supply chain once COVID shutdowns arose.

At the onset of COVID, many thought the pandemic would stall demand for critical construction supplies such as wood. But what few economists or forecasters saw coming was a pandemic-induced migration that spiked demand for residential construction, as homeowners decided to use lockdowns as time for major home renovations and expansions, while others indefinitely left major urban centers for more space, resulting in a demand for housing nowhere near its supply.

What’s more, the construction industry was almost immediately deemed an “essential” business by the government. So as other industries were forced to cut back or stall production entirely, in the U.S. and most other countries’ jobsites kept on humming with enhanced safety protocols in place, keeping demand for building materials high but supply tight.

As COVID eased and factory production and shipping began to resume, an already depleted port, trucking and rail transportation industry, all of which incurred pre-pandemic labor shortages, were overwhelmed by daily arrivals of cargo ships. The U.S. was already facing a truck driver shortage even before COVID, but the nationwide shutdown slowed down commerce and resulted in many drivers going on unemployment. That lack of drivers, which persists, has led to higher shipping rates. Even if ships were able to unload, limited warehouse facilities could not accommodate the influx of shipments.

Forecasting demand is critical to inventory control and to the underlying management of a business’s supply chain. The bullwhip effect is a phenomenon triggered by fluctuations in any link in a product supply chain – usually at the demand end. When demand fluctuates, those changes can reverberate up the supply chain and trigger reactive supply distortions. In a simple example, if a paint contractor who regularly purchases a thousand gallons of paint places an order for 2000 gallons of paint, that surge in demand triggers reactions throughout the supply chain. The paint vendor places an order for twice its regular stock of paint, which in turn triggers increases throughout layers of discrete supplier orders. The paint company’s can, pigment, and labeling suppliers all increase their inventory to meet anticipated sales of twice the normal volume of paint. The bullwhip effect can also be triggered on the supply side. Within the construction industry, supply shortages during the pandemic triggered runs on virtually all categories of building materials, with lumber and roofing materials leading the way.

To mitigate bullwhipped supply chain distortions, businesses have to be far more diligent in understanding their supply chains and must understand the causes of demand fluctuations. Forecasting must become far more refined, and myriad software companies are now promoting supply chain management software that provides real-time data on supply and demand fluctuations. Presumably, this more thorough and timely data enables businesses to better forecast demand and manage inventory and supply lead times, and it provides more reliable analysis of the root causes of supply and demand fluctuations. So too, by streamlining product supply chains, links in the chain can be removed and thereby reduce the total number of opportunities for supply chain disruption.

- Construction Materials Supply Specifics: Lumber, Ductile Iron Pipe, Cement

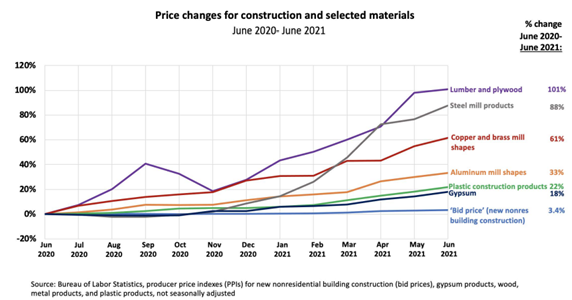

As if supply alone were not enough of a challenge, the cost of available materials has skyrocketed, and the recent spike in fuel costs is driving further increases. The chart below illustrates the price volatility of six common construction materials and comparing them against the incredibly modest increase in bid prices over the same period.

According to a May, 2022 price report by AGC economist Ken Simonson, construction supply costs were up across the board, with increases reported for aluminum products (6 months in a row); diesel fuel (18 months); freight (13 months); polyvinyl chloride (PVC) products (9 months); and steel products (17 months). Items listed in short supply included appliances (3 months), steel products, transformers, and wire and cable. A few core building materials provide a representative view into how the production and supply of key building materials have been impacted before, during, and after the pandemic.

Lumber

As the COVID shutdown spread, lumber became extremely hard to come by, as mills initially curtailed production in early 2020 expecting a flattening of demand. But in fact, demand surged due to a resulting boom in residential renovations and new housing starts that skyrocketed during the pandemic. Supply shortages and price spikes rose throughout much of 2020 into 2021. Some frustrated contractors captured their ire visually:

The U.S. is highly dependent on imported dimensional lumber and wood products such as wood flooring, but it is also an exporter of forest products, namely to China. The U.S. sells logs and lumber to China; China uses the logs and lumber to produce finished wood products, such as furniture and hardwood flooring; and China exports these finished wood products to the world. Interestingly, the U.S. market is the leading destination for these exports.

Prior to the pandemic, the U.S.-China trade war had already made the forestry sector vulnerable because of the tariffs that the Chinese government imposed on U.S. timber and the resulting loss in exports. Thus, the forest products industry was already in a crisis when COVID hit.

Roughly a quarter to one-third of lumber imported to the U.S. comes from Canada. Despite record-high lumber prices in the U.S. in 2020, Canadian lumber shipments to the U.S. fell for the fourth consecutive year. The trend was largely due to a reduction in the Annual Allowable Cut in the province of British Columbia, which reduced production volumes in that region by over a third in just five years.[v]

A majority of the overseas lumber imports in 2020 originated from Europe. Sawmills from this region have steadily expanded their sales to the U.S. over the past three years. Throughout 2020, European shipments inched close to 3.3 million m3, up from 2.1 million m3 in 2019.[vi] Germany is by far the largest European supplier of lumber, followed by Sweden and Austria. However, it is expected that U.S. softwood lumber demand will increasingly be met by expanded supply from the U.S. South, Eastern Canada, and overseas. With Western Canadian lumber exports expected to continue to dwindle, the US softwood lumber demand will increasingly be met by expanded supply from the US South, Eastern Canada, and overseas.

U.S. imports declined to 479 million board feet in the fourth quarter of 2020, down 15% from the 565 mmbf shipped in the third quarter and lagging the same three quarters of 2020 by 26%. Imports peaked at 649 mmbf in the second quarter, which was a 14-year high. Imports from the 10 largest European suppliers reached 1.6 bbf last in 2021, up 16% from 2020. A second-half decline was clearly evident in European exports to the U.S. Shipments through the third quarter were up 36% compared to the 2020 pace. Strong prices within Europe, soaring ocean freight costs, and extensive shipping delays contributed to the late-year slowdown in exports.[vii]

Ductile Iron Pipe

Ductile iron pipe (“DIP”) is the primary form of cast iron pipe used for transmission of potable water. A succession of both domestic and international events has presented extreme challenges to production of this critical building material.[viii]

DIP is typically manufactured with a cement mortar lining and textured polymer protective coatings on the outer surface to inhibit corrosion. The economic downturn of 2006-09 triggered consolidation and closure of DIP production facilities. Where there were twelve DIP producing plants in the U.S. before the downturn, there are just seven today.

Like so many industries, the onset of COVID caused widespread labor shortages impacting production and shipment of DIP, and also the unavailability of machine parts further impaired plant maintenance. A year into the pandemic, the industry was further rocked by ice storms and Hurricane Ida, which caused substantial disruption to resin production in the Gulf States region – resin used to make PVC. A PVC pipe shortage then triggered a shift to and run on DIP supplies.

DIP is made from 95% recycled scrap metals. Refined steel, on the other hand, is made from pig iron, or crude iron, is a high carbon content form of raw iron. As it happens, Russia and Ukraine are the two largest exporters of pig iron, representing about 65% of global output. With the outbreak of war in Ukraine, pig iron exports from those countries ground to a halt, prompting steel producers to compete for those same scrap metal supplies used in the production of DIP.[ix]

Compounding the problems of raw material supply and labor shortages is the recent spike in fuel costs. Production of DIP requires substantial energy expenditure to render molten metal which is then centrifugally spun in casting molds. With almost doubling of fuel costs, the cost of DIP production has increased exponentially.

Paints and Coatings

Like ductile iron pipe, the paint and coatings industry has also incurred a succession of production challenges, most notably raw material supply dispruptions. The production of paints and coatings is dependent on the ready supply of resins, pigments, and base compounds, most of which are produced in Asia. Titanium dioxide, the same compound used in sunscreens, is almost entirely sourced from China. As a common paint additive, titanium dioxide provides opacity and durability, and enhances the longevity of paints.

Unlike ductile iron pipe, the paint industry experienced a huge spike in demand at the same time supply chain disurptions began to manifest. As lockdowns and stay-at-home work spurred homeowner renovations and flight to suburban housing, paint sales soared. Sales at paint and wallpaper stores in the U.S. spiked 7.8% annually in June 2021 to $1.34 billion.

As the impact of plant shutdowns due to COVID took hold, paint manufacturers scrambled to procure pigments, resins, and additives such as titanium dioxide – and cans, most of which became scarce or unobtainable.[x] Complicating efforts to source pigment from alternate suppliers is the fact manufacturers cannot simply use a secondary source because even the slightest variation in pigment precludes accurate color reproduction.

As with ductile iron pipe producers, paint producers were also stymied by the same loss of resin production caused by Hurricane Ida throughout the Gulf States region, and likewise impacted by the extreme winter freeze across Texas in early 2021 that resulted in the loss of huge inventories that were destroyed by subfreezing temperatures.

Cement/concrete is the second-most-utilized product in the world after potable water. The material is key to building housing, roads, airports, and other infrastructure needed to support economic development. Globally, more than 1,000 cement producers operate over 2,300 integrated cement plants and over 600 grinding stations. Five countries account for nearly three-quarters of the world’s cement production: China leads with a 57-percent share, followed by India, Vietnam, United States, and Indonesia. The majority of plants are privately owned and operated, and while the top 10 players account for about 45 percent of global capacity, the industry overall is quite fragmented.[xi] Unlike other materials, the cement production involves a huge carbon footprint caused by the extensive energy expended to transform raw materials into finished cement.

Cement is manufactured by high temperature heating of silica, alumina, and iron, which results in a material called “clinker”, which is then ground and mixed with limestone and gypsum to produce concrete. Concrete is essentially a mix of aggregates (sand and gravel or crushed stone) and paste (water and cement). Portland cement is a generic term to describe the type of cement used in almost all concretes.

In 2021, U.S. production of cement remained under the 2005 record due to idle production plants, underutilized capacity at other plants, disruptions due to plant improvements, as well as the decreased costs of importing cement.

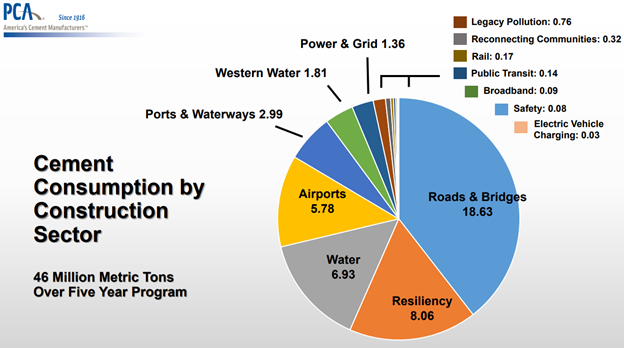

A Portland Cement Association (“PCA”) survey found that 28 states were experiencing supply disruptions.[xii] These disruptions have arisen at a time when cement demand is on the rise. Cement consumption through June 2021 increased 7.4% according to the PCA, and robust growth is expected as funding for infrastructure projects funded by the $1 trillion Infrastructure Investment and Jobs Act is dispersed to and applied by states. To update 20,000 miles of highways and repair of 10,000 bridges, the PCA estimates an increased cement demand by more than seven million metric tons per year annually. The following chart shows the anticipated distribution of cement over project type during the next 5-year period as identified by the Portland Cement Association in its Spring, 2022 market forecast.

On March 30, 2022, the Tennessee Concrete Association (“TCA”) issued an urgent alert to industry members about concrete supply shortages across that state. The TCA alert sited unprecedented supply chain problems inhibiting delivery of raw materials used in concrete production, including Portland cement, admixtures, aggregate and fly ash. The alert noted that Portland cement supplies were being rationed and ready-mix producers were reducing plant hours. The concrete shortage has been attributed to numerous factors, including an already tight labor force in the industry, plant closings and maintenance shutdowns during the pandemic that depleted inventory, and a shortage of drivers.[xiii]

These supply constraints were predicted to persist throughout 2022 and are not confined to Tennessee. Similar shortages have been incurred in Alabama, Mississippi, Louisiana, Texas, Nevada, and California.

The Way Forward – Managing Supply and Price in an Uncertain Market

Re·sil·ient /rəˈzilyənt/: (1) able to withstand or recover quickly from difficult conditions; (2) able to recoil or spring back into shape after bending, stretching, or being compressed.

The dominant buzzword in the unfolding discussion of supply chain management is resilience. By “resilient supply chain” many commentators seem to refer to: (1) keen awareness of demand cycles and production needs; (2) supplier relationships that are well understood and more deliberately cultivated; (3) real-time supply data that is closely monitored, and (4) defined contingency options that can be employed if otherwise routine supply lines are disrupted. But, because business supply chains vary widely from business to business, there are no one-size-fits-all solutions for achieving supply chain stability. Instead, there are a range of tactics businesses can utilize to blunt supply and price volatility.

In construction, contractor’s grapple with at least two core supply chains, the supply of equipment, parts and tools that are necessary to enable the contractor to construct, and the supply of materials necessary to construct the project itself. Beneath the contractor are layers of subcontractors, each managing these same supply chains relative their respective trades. In large measure, the owner and architect are at the mercy of these constructor supply chains. What recent supply chain disruptions have forced is far more deliberate awareness, management, and coordination of supply challenges at all levels of project planning, design and construction, including recurring operational supply needs and project specific supply needs.

Non-Project Specific Operational Control

Risk Engineer Cheri Hanes with North America Construction advises supply management has become so critical that contractors should establish dedicated supply chain leadership. This leadership team may be organized on both a company-wide and project specific basis such that the contractor’s supply needs are understood and tracked as projects are evaluated, contracted for, and executed.[xiv] Hanes also recommends contractors develop project selection and bidding protocols that enable “go/no-go” decision-making in light of potential supply chain challenges, including such considerations as: (1) working with known owners who demonstrate fair contract management, and who are flexible relative to design or material changes; (2) developing and insisting on reasonable schedule commitments; (3) using reasonable and current assumptions around cost that accurately account for anticipated price escalations; and (4) selecting projects that align with the company’s core competencies.

Hanes also encourages implementation of a materials management plan for all at-risk materials which track material procurement from point of origin to the project site. The plan imposes supply monitoring procedures to confirm materials are being fabricated, that they are in route to the project with known arrival times. Once delivered, materials are checked against submittals to verify conformity with project requirements. She counsels that in an environment where substitutions are more likely to occur, general contractors must be more proactively involved with subcontractor material supply as well. Supply disruptions can further be mitigated by more deliberate collaboration between all project stakeholders whereby material supply challenges and contingency plans are actively reviewed at the earliest possible stage of bidding and continue over the life of each project.

Contractors can also reduce supply demand by more aggressively managing equipment maintenance and preservation and by reducing construction material waste. In 2018, construction (not including demolition) in the U.S. generated almost 60 million tons of construction materials waste.[xv] Reducing waste is perhaps the easiest means of mitigating material supply pressures, and involves simple, commonsense practices like reducing construction mistakes, ordering the right amount of materials in the right-size for the job, storing materials properly, and recycling and reuse.

Project Specific Contracting Controls

So much of the discussion about mitigating construction supply chain disruption has centered on a seeming preoccupation with a singular solution – force majeure relief – the idea that unanticipated supply disruption can somehow be mitigated if only the contractor’s problem is “excused.” But, while having such a contractual safe harbor is no doubt beneficial, force majeure relief still involves subjective judgment calls about whether any given disruptive event is worthy of contract relief. The following force majeure term imposes broad relief parameters intended to maximize the potential for actual recognition of a disruptive project event.

12.8 Force Majeure – Neither Party shall be liable to the other for any failure or delay in performing an obligation under this Agreement that is due to any of the following causes, to the extent beyond its reasonable control: acts of God, accident, riots, war, terrorist act, epidemic, pandemic, quarantine, civil commotion, breakdown of communication facilities, slowdowns and/or stoppages of supplier delivery of equipment, materials or goods related to the project, breakdown of web host, breakdown of internet service provider, natural disasters and catastrophes, governmental acts or omissions, orders of health departments or other government officials, changes in laws or regulations, national strikes, fire, explosion, or other causes of damage to the Project site, or generalized lack of availability of raw materials or energy. The Contractor and its subcontractors shall not be required to perform any service that would require or may result in exposure of their employees to hazardous or unsafe conditions. Remote meetings and remote site observation and inspection by camera, web camera, video camera, unmanned aerial vehicle, or similar platform is authorized for all purposes if reasonably necessary to avoid exposing such employees to unsafe conditions.

Beyond force majeure safeguards there are a wealth of other contract terms that are critical to managing unforeseen, or foreseen but not yet manifest, supply disruptions and price volatility. They include:

- Use of allowances as a placeholder for the expected “Cost of the Work.” If the allowance item costs more than the placeholder, the GMP is increased. If it is less, then the owner should get a deductive change order.

- Use of equitable adjustment terms that enable the contractor to apply for additional time or compensation.

- Use of ConsensusDocs Cost-adjustment clause, Document 200.1, Time and Price Impacted Material Amendment 1:

POTENTIALLY TIME AND PRICE-IMPACTED MATERIAL As of the date of this Amendment, certain markets providing essential materials to the Project are experiencing or are expected to experience significant, industry-wide economic fluctuation during the performance of this Agreement that may impact price, availability and delivery time frames (“Potentially Time and Price-Impacted Material”). This Amendment provides for a fair allocation of the risk of such market conditions between the Owner and the Contractor and shall only apply to the Potentially Time and Price-Impacted Material(s) listed in Schedule A to this Amendment.

TIME-IMPACT AND AVAILABILITY If the Contractor is delayed at any time in the commencement or progress of the Work due to a delay in the delivery of, or unavailability of, a Potentially Time and Price-Impacted Material, beyond the control of and without the fault of the Contractor, its Subcontractors and Material Suppliers, the Contractor shall be entitled to an equitable extension of the Contract Time and an equitable adjustment of the Contract Price in accordance with section 6.3 of the Agreement. The Owner and Contractor shall undertake reasonable steps to mitigate the effect of such delays.

Notwithstanding any other provision to the contrary, the Contractor shall not be liable to the Owner for any expenses, losses or damages arising from a delay in the delivery of a Potentially Time and Price-Impacted Material item not the fault of the Contractor, its Subcontractors and Material Suppliers.

- AIA A201-2017 General Conditions typically allow contractors to seek an extension of time for unavoidable delays associated with construction materials, but these General Conditions do not specifically address industry-wide price escalations caused by changes to the availability of essential materials.

- Use of disclaimer language in bid proposals. While bid proposals are usually supplemented by a subsequent agreement executed between the parties, conditional language in a party’s proposal can provide some coverage between the time of bid and the execution of their agreements after award of the job. For example, contractors and subcontractors can include language that makes their bid expressly contingent upon the current price and availability of materials and allows them to seek an equitable adjustment to their bid price if there are significant changes to the pricing and/or availability of material.

- Subcontractors should also consider including language in material purchase orders to pass down the risk of material price changes to their suppliers. Subcontractors should also require their suppliers to give prompt written notice in the event of unforeseen changes to the delivery schedule so that notice can be timely given upstream to the contractor and owner.

Aside from negotiated contract terms, relief from contract performance may lie in various equitable legal doctrines, including:

- Impossibility of performance – while narrowly applied, the doctrine of impossibility of performance may be invoked due to an unforeseeable event or prohibited by operation of law. A state-imposed lockdown would likely constitute just such an impediment to performance.

- Impracticability – the UCC excuses performance by a seller of goods where it can demonstrate that performance may be so difficult and expensive that it becomes impracticable, though not objectively impossible.

- Frustration of purpose – this limited excuse from contract performance applies in some jurisdictions when, due to a supervening event, the impacted party’s main purpose for entering the transaction is destroyed or removed. The frustrated purpose is so much the basis of the contract that without it, the transaction makes little sense. Frustration can excuse performance only if:

- The impacted party seeking to be excused can no longer accomplish its purpose for the transaction;

- Both parties knew of the impacted party’s principal purpose for entering into the contract; and

- A qualifying supervening event caused the frustration.

Closing Thoughts

Supply chain disruptions and corresponding price volatility were being encountered long before the pandemic struck in early 2020, principally due to trade wars and increased competition for a finite supply of materials. But the pandemic triggered an intense acceleration in the review and management of supply chain dynamics. The pandemic also expanded the scope of impacted construction industry stakeholders. No longer was it just the constructor in the field who was confronted with disruption of operations, but also owners, designers, and a myriad of vendors who service the construction industry. Going forward, perhaps the leading lesson learned is that the ready supply of all tangible goods necessary to execute a construction project, be it equipment, parts to maintain equipment, tools, or construction materials can no longer be assumed, but must instead be very deliberately managed from the point of bidding through substantial completion – and perhaps even through the en

[i] R.C. Estall, Stock control in manufacturing: the just-in-time system and its locational implications, Department of Geography, London School of Economics and Political Science, Area (1985) Vol. 17.2, 129-133.

[ii] https://www.netsuite.com/portal/resource/articles/inventory-management/just-in-time-vs-just-in-case.shtml#:~:text=direct%20procurement%20costs.-,Disadvantages,30%25%20of%20total%20inventory%20value.

[iii] Blockchain and Smart Contracts: A Solution for Payment Issues in Construction Supply Chains, Samudaya Nanayakkara, May 27, 2021.

[iv] Blockchain and Smart Contracts: A Solution for Payment Issues in Construction Supply Chains, Samudaya Nanayakkara, May 27, 2021.

[v] The US is Increasingly Dependent on Overseas Lumber Supply as Canadian Softwood Lumber Production Continues to Decline, Wood Resources International, January 18, 2021.

[vi] Id.

[vii] Id.

[viii] How Multiple Events Collided to Affect Ductile Iron Pipe Supply, McWane Ductile blog, April 21, 2022.

[x] Francis, Scott, Coatings Industry Navigates Supply Chain Disruption, Products Finishing, April 20, 2021.

[xi] https://www.ifc.org/wps/wcm/connect/c015acbf-8465-4f8e-95e8-857511f10bbb/202008-COVID-19-impact-on-cement-industry.pdf?MOD=AJPERES&CVID=ngxQLJQ

[xii] Strickland, James, Reducing Risk in Supply Chain Management, Holcim US, December 14, 2021.

[xiii] Oberoi, Mohit, Parts of the U.S. Deal With Cement and Concrete Shortage, Not Nationwide, Market Realist Magazine, April 5, 2022.

[xiv] Hanes, Cheri, Supply Chain, Cost, and Materials Management Strategies for Construction, https://axaxl.com/fast-fast-forward/articles/supply-chain-cost-and-materials-management-strategies-for-construction, August 24, 2021.

[xv] Sustainable Management of Construction and Demolition Materials, United States Environmental Protection Agency 2018 Fact Sheet; https://www.epa.gov/facts-and-figures-about-materials-waste-and-recycling/advancing-sustainable-materials-management.